Nubank

Nubank is a pioneering Brazilian startup company in the financial services segment, operating as a credit card and fintech operator with operations in Brazil, Mexico and Colombia.

- Year: 2022-2023

- Duration: 1 week

- My hole: staff product designer

- Credits on the end of this page.

Challenge

As a Lending team member, my hole objective, as a staff product designer, is to increase performance and improve the user experience in the hiring flow process. With that in mind, this project had the objective to improve 3% of new hires coming from the new layout.

We had a full week (5 days) to explore, test, refine, and make a decision on the rollout proposal. This was the main challenge.

Oh, and this was my first week working at Nubank, so I used a lot of knowledge from the team to understand the product limitations and its main findings. :)

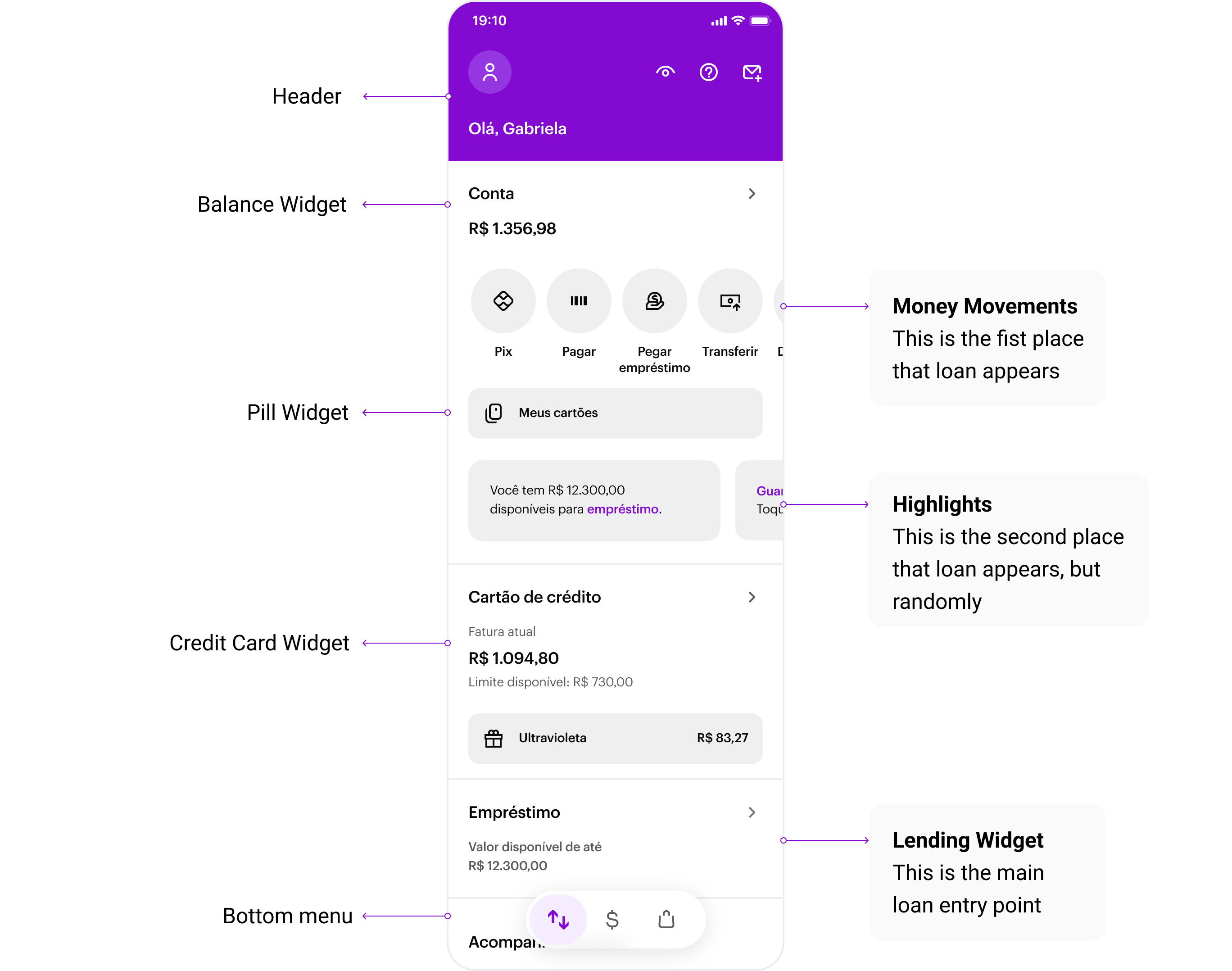

Current home

Among the products displayed on the app homepage, lending has three main entry points, which lead to the loan hiring flow or managing active loans.

Alignments

As we have three entry points in the home, but another team takes care of it, many alignments were necessary in order to maintain product consistency, as well as the user experience and also between product teams.

At the end of the day, alignment, alignment and alignment was much necessary for this step.

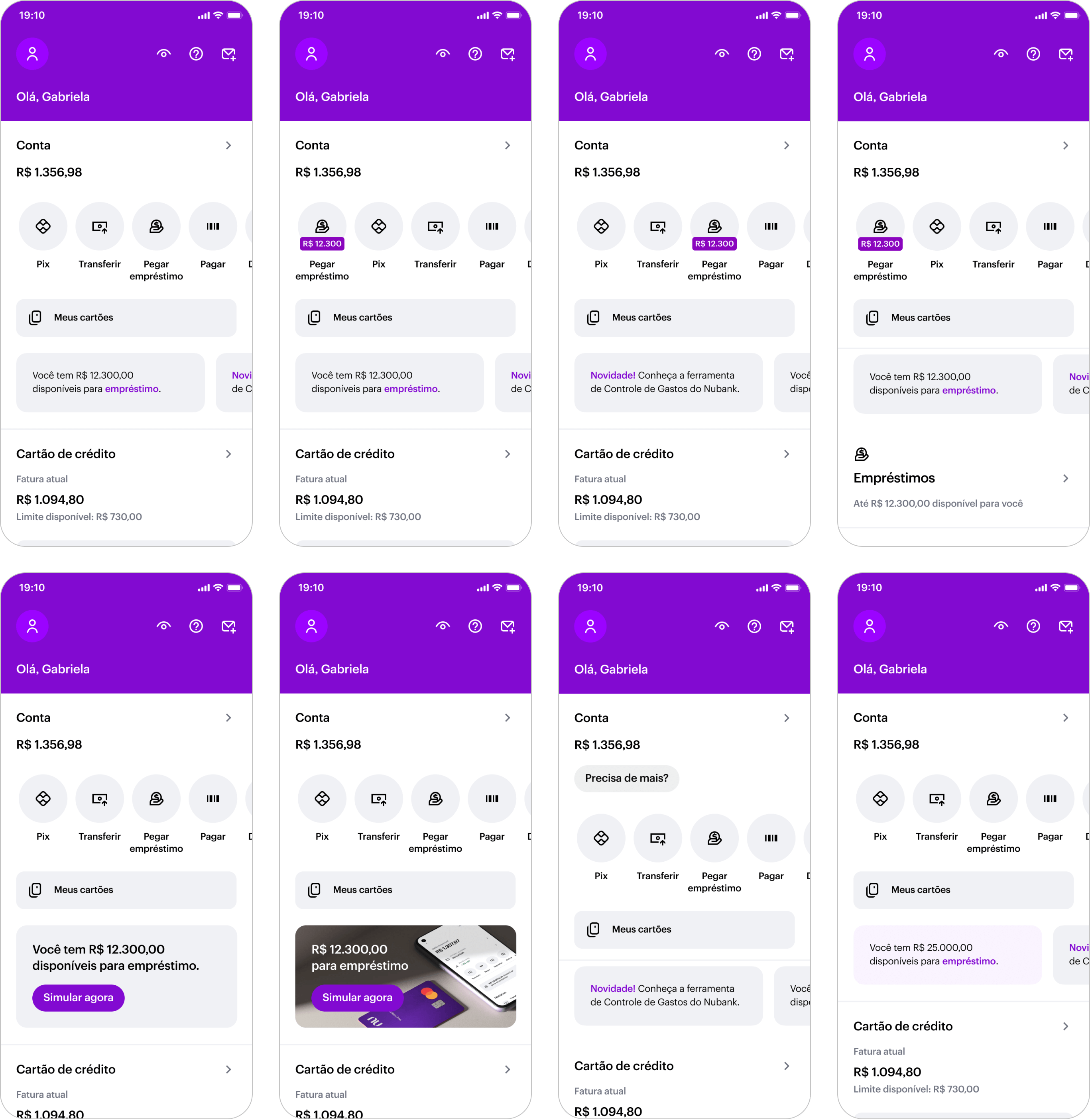

Visual explorations

As we had little time, we ideally went for visual explorations, which consisted of developing proposals to solve the challenge. Some of these visual explorations can be seen below.

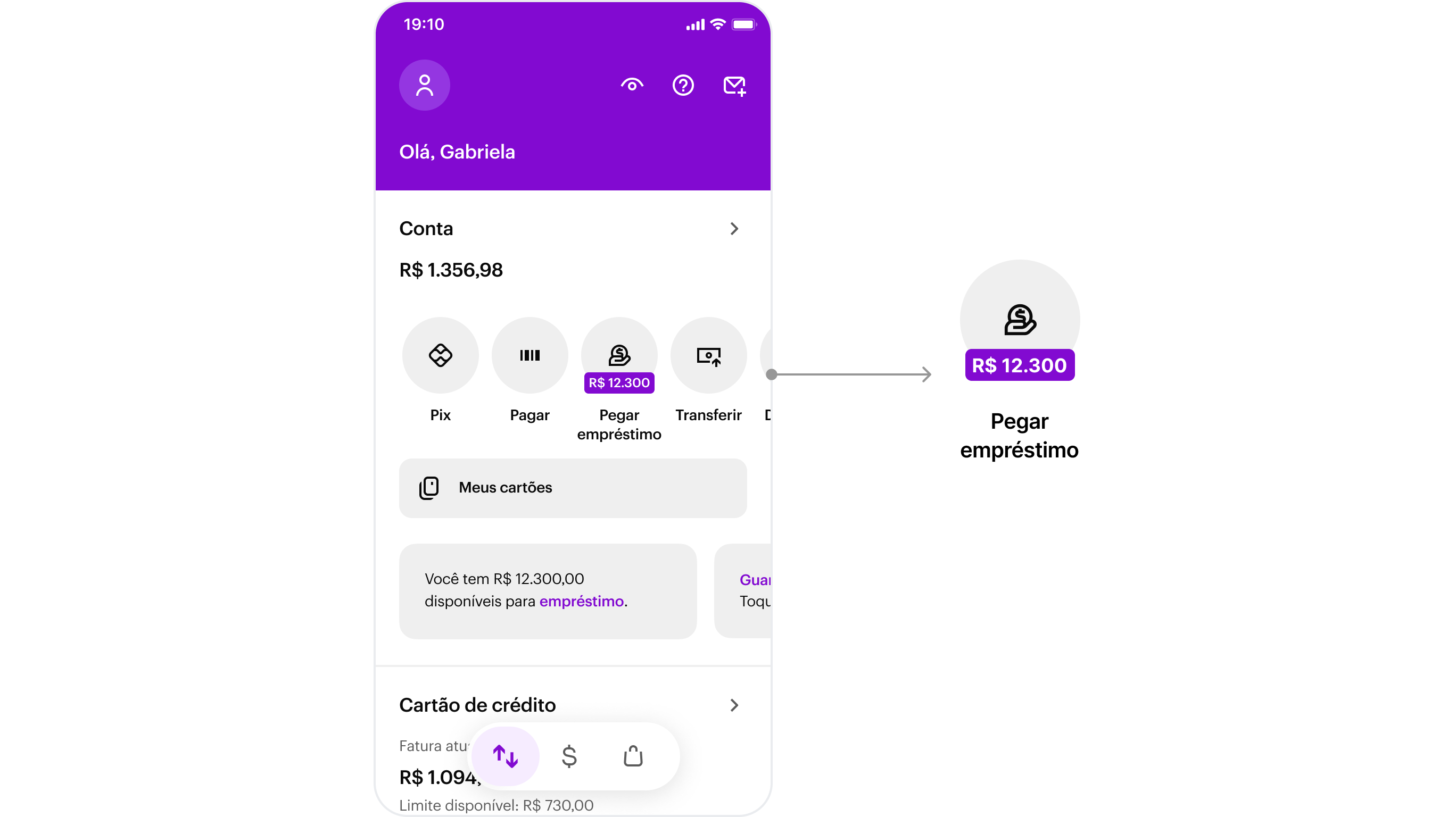

Final design

Results

We implemented the label at a time of tension regarding fraud occurring in several national banks, and despite the negative repercussions on some social networks, the performance during the first week was 10% more than expected. In other words, an extremely positive result. Because of this, we decided to implement it for the entire customer base and today it is reflected to the entire population of Nubank's client.

Not bad for the first two weeks of work at the biggest digital bank in Latin America. :)

As future improvements, there is a need to reduce entry points in the home and focus on just one location, gathered in one place, to increase performance.